|

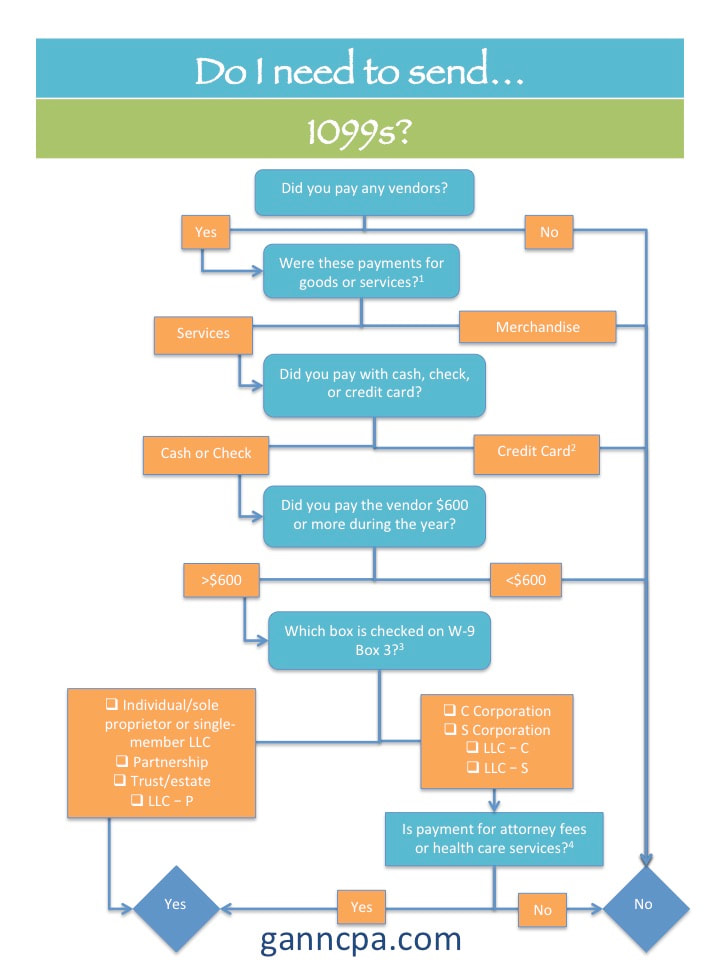

1. Considered “goods” and not reportable: Payments for merchandise, telephone, freight, storage, and similar items. 2. Credit Card payments are reported by merchant services provider on Form 1099-K. 3. Entities treated as corporations for tax purposes do not need to receive 1099s. 4. Corporations paid for attorney fees or health care services are not exempt from 1099 filings.  New vendor When you hire a new vendor, request that they send you a copy of their W-9. It has the information needed to prepare 1099s. If a vendor will not send their W-9, you may be required by the IRS to withhold 28% of payments to the vendors. <<< Click to download W-9 form.  1099s 1099s may be generated using your accounting system (QuickBooks Online, etc) or an online service (tax1099.com, 1099online.com, etc), or hand written. <<< Click to download 1099 form.

3 Comments

Jim S.

4/20/2023 04:52:28 pm

It is always a good idea to confirm early whether you need to send 1099s. You don't want to find yourself caught in the eleventh hour and unprepared. Getting 1099 software is a solution that worked for my business: https://1099-etc.com/payroll-software/w2-and-1099-forms-filer/. I never find myself needing to run out at the last minute to buy a fresh batch of forms.

Reply

7/24/2024 07:02:34 pm

Agreed. I've found myself unprepared before and won't ever let it get to that point again. Software really does help. We use a program that lets us enter "live" or after-the-fact payroll throughout the year by check. We are so much more organized now.

Reply

Crystal S.

2/22/2024 08:07:47 pm

Don't wait until the last minute to figure out where you stand with filing 1099s. I recommend equipping yourself with trustworthy software: https://1099-etc.com/payroll-software/w2-and-1099-forms-filer/. Good tax software often provides W-2 and 1099 reports for users. What you don't use this tax season can come in handy next year.

Reply

Leave a Reply. |

Lauren Gann, CPAProving resources for your accounting questions Archives

June 2022

Categories

All

|

RSS Feed

RSS Feed