Photo by Erik Mclean Photo by Erik Mclean The IRS is increasing the mileage rate to 65 cents for the second half of 2022. Read more: https://www.irs.gov/newsroom/irs-increases-mileage-rate-for-remainder-of-2022#:~:text=The%2014%20cents%20per%20mile,an%20increase%20was%20in%202011

0 Comments

If you are a contract worker or small business owner, you may be able to deduct home office expenses on your tax return, even if you are a renter. Tax law changes in 2018 prevent employees with exclusively W2 income from taking advantage of this deduction. But, if you have 1099 or Schedule C income, you may be able to claim a portion of your mortgage/rent, utilities, and other home expenses. Read more: www.irs.gov/newsroom/how-small-business-owners-can-deduct-their-home-office-from-their-taxes www.cnbc.com/2021/12/03/who-can-claim-home-office-tax-deduction-if-they-worked-from-home.html

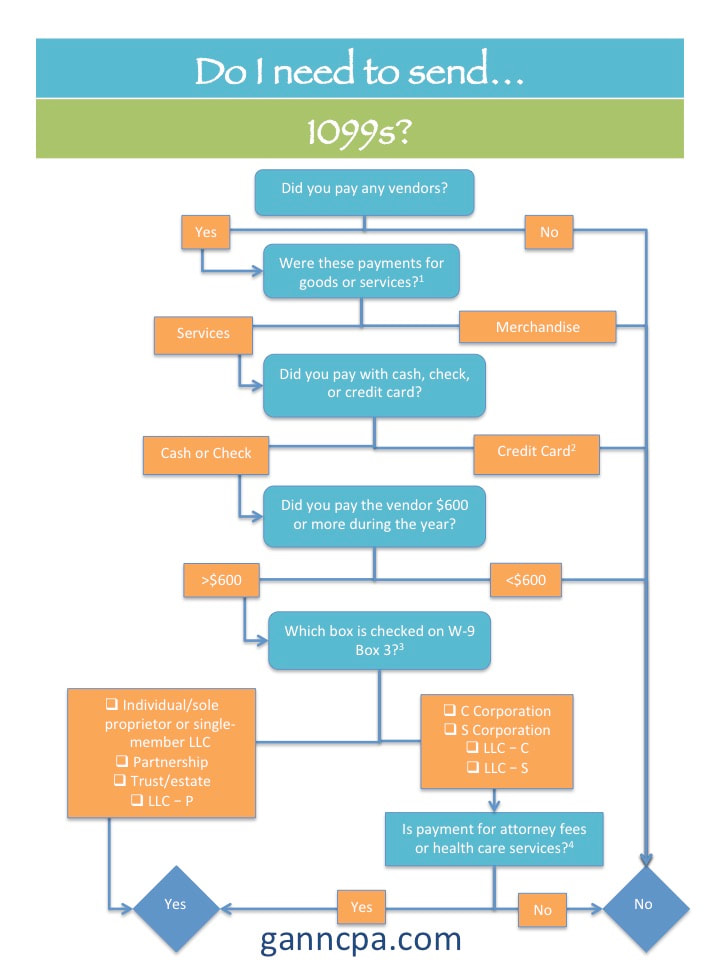

1. Considered “goods” and not reportable: Payments for merchandise, telephone, freight, storage, and similar items. 2. Credit Card payments are reported by merchant services provider on Form 1099-K. 3. Entities treated as corporations for tax purposes do not need to receive 1099s. 4. Corporations paid for attorney fees or health care services are not exempt from 1099 filings.  New vendor When you hire a new vendor, request that they send you a copy of their W-9. It has the information needed to prepare 1099s. If a vendor will not send their W-9, you may be required by the IRS to withhold 28% of payments to the vendors. <<< Click to download W-9 form.  1099s 1099s may be generated using your accounting system (QuickBooks Online, etc) or an online service (tax1099.com, 1099online.com, etc), or hand written. <<< Click to download 1099 form. |

Lauren Gann, CPAProving resources for your accounting questions Archives

June 2022

Categories

All

|

RSS Feed

RSS Feed